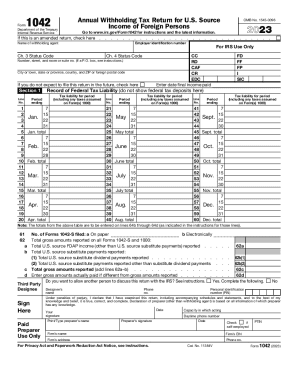

IRS 1042 2024-2025 free printable template

Show details

Enter overpayment applied as credit from 2023 Form 1042. Credit for amounts withheld by other withholding agents Total payments. Check if self-employed Phone no. Cat. No. 11384V Form 1042 2024 Page 2 Total tax reported as withheld or paid by withholding agent on all Forms 1042-S and 1000 a Tax withheld by withholding agent. No. of Forms 1042-S filed a On paper b Electronically Total gross amounts reported on all Forms 1042-S and 1000 a Total U.S. source FDAP income other than U.S. source...

pdfFiller is not affiliated with IRS

Understanding and Effectively Utilizing IRS Form 1042

A Comprehensive Guide to Editing IRS Form 1042

Instructions for Accurately Completing IRS Form 1042

Understanding and Effectively Utilizing IRS Form 1042

IRS Form 1042 is a critical document primarily used by U.S. payers to report income paid to foreign persons, including non-resident aliens and foreign entities. The importance of IRS 1042 lies in its role in ensuring compliance with U.S. tax laws while facilitating the proper withholding of tax on certain types of income. Below, we provide straightforward guidance on the use and completion of IRS Form 1042 to streamline your filing process.

A Comprehensive Guide to Editing IRS Form 1042

Editing your IRS Form 1042 accurately is crucial for compliance. Follow these steps to ensure your information is complete and correct:

01

Collect necessary documentation, including payments made, withholding taxes applied, and the beneficiary’s details.

02

Review each section of the form against your records, ensuring that all amounts correspond with your financial statements.

03

Utilize tax preparation software, if possible, to reduce the risk of errors and improve the efficiency of the editing process.

04

Check for accuracy in names, addresses, and identification numbers to avoid mismatches that could lead to penalties.

Instructions for Accurately Completing IRS Form 1042

Filling out IRS Form 1042 involves several key steps:

01

Enter the name and address of the withholding agent in the appropriate fields.

02

List the names, addresses, and identification numbers of all foreign payees.

03

Indicate the total payments made to each payee and corresponding withholding amounts.

04

Sign and date the form to validate the information provided.

Show more

Show less

Latest Developments and Adjustments in IRS Form 1042

Latest Developments and Adjustments in IRS Form 1042

Stay updated on any changes regarding IRS Form 1042 to ensure compliance and accuracy in your filings. Recent adjustments include:

01

Increased income thresholds that determine withholding requirements, directly affecting foreign beneficiaries.

02

Revisions in reporting procedures which may now allow certain electronic submissions.

03

Updated guidelines surrounding documentation requirements for specific types of exempt income, enhancing clarity for payers.

Key Aspects of IRS Form 1042: Purpose and Usage

Defining IRS Form 1042

The Function of IRS Form 1042

Who is Required to File IRS Form 1042?

Criteria for Exemption from IRS Form 1042

Understanding the Components of IRS Form 1042

Important Filing Deadline for IRS Form 1042

Comparison of IRS Form 1042 with Similar Forms

Relevant Transactions Covered by IRS Form 1042

Submission Requirements: Copies of IRS Form 1042

Understanding the Penalties for Non-Compliance with IRS Form 1042

Essential Information Needed for Filing IRS Form 1042

Other Forms Necessary for IRS Form 1042 Submission

Submission Address for IRS Form 1042

Key Aspects of IRS Form 1042: Purpose and Usage

Defining IRS Form 1042

IRS Form 1042 is utilized by withholding agents to report tax withheld on payments made to foreign individuals and entities. This includes interest, dividends, rent, and royalties earned by non-resident taxpayers.

The Function of IRS Form 1042

The primary purpose of IRS Form 1042 is to facilitate the correct withholding of U.S. taxes on income derived from U.S. sources by foreign payees. This mechanism helps ensure that the IRS collects taxes that may otherwise go unpaid.

Who is Required to File IRS Form 1042?

Entities and individuals who make payments to foreign persons must file IRS Form 1042. This includes:

01

U.S.-based corporations, partnerships, and individuals making payments to non-residents.

02

Financial institutions and organizations that issue interest payments or dividends to foreign persons.

03

Anyone operating under a trade or business in the U.S. that pays royalties to foreign entity owners.

Criteria for Exemption from IRS Form 1042

Certain payees can claim exemptions under IRS regulations, including:

01

Income that falls below specific threshold amounts, such as de minimis exemptions for small payments.

02

Payments made to foreign governments or international organizations.

03

Types of income explicitly excluded from U.S. withholding, for instance, capital gains from the sale of personal property.

Understanding the Components of IRS Form 1042

Key sections of IRS Form 1042 include the withholding agent's information, detailed payee information, total payments made, and the amounts withheld per payee. Each component must be completed meticulously to avoid errors during the submission process.

Important Filing Deadline for IRS Form 1042

The deadline for submitting IRS Form 1042 is typically March 15 of the year following the tax year in which payments were made. Compliance with this deadline is essential to avoid potential penalties or legal actions.

Comparison of IRS Form 1042 with Similar Forms

When comparing IRS Form 1042 to Form 1042-S, it's important to note the distinctions. Whereas Form 1042-S serves as an information return reporting specific payments made to foreign individuals, Form 1042 consolidates the total withholding tax liability. Understanding this difference ensures appropriate filing based on your business scenario.

Relevant Transactions Covered by IRS Form 1042

Common transactions that require reporting on IRS Form 1042 include:

01

Interest payments made to foreign lenders.

02

Dividends allocated to foreign shareholders.

03

Royalties paid for the use of patents or copyrights to foreign entities.

Submission Requirements: Copies of IRS Form 1042

When submitting IRS Form 1042, it is typically required to submit one copy to the IRS and also provide copies to the foreign payees. Ensure you retain copies for your records to facilitate any necessary future audits.

Understanding the Penalties for Non-Compliance with IRS Form 1042

Failure to submit IRS Form 1042, or inaccuracies in the submission, can lead to severe penalties. Examples include:

01

A $250 fine per form for failure to file, which can escalate with repeated offenses.

02

Potential legal implications including interest on unpaid taxes and further tax liabilities.

03

Criminal charges based on deliberate non-compliance or fraudulent reporting.

Essential Information Needed for Filing IRS Form 1042

Gather the following information before filing IRS Form 1042:

01

Withholding agent's name, address, and identification number.

02

Complete details of each payee, including names and tax identification numbers.

03

Accurate records of payment dates, amounts, and tax withheld against each transaction.

Other Forms Necessary for IRS Form 1042 Submission

In conjunction with IRS Form 1042, you may also need to file IRS Form 1042-S to report income specifics detailed in the 1042. Ensure that both forms are accurate and consistent with the information provided.

Submission Address for IRS Form 1042

IRS Form 1042 must be sent to the appropriate IRS service center, which can vary based on the geographical location of the payer. Always verify the submission address on the IRS website to ensure timely processing.

By following this comprehensive guide on IRS Form 1042, you can navigate the complexities of U.S. tax obligations concerning foreign payments with confidence. For tailored assistance or to begin your filing process today, consider reaching out to a tax professional or utilizing advanced tax preparation software.

Show more

Show less

Try Risk Free